Modified Endowment Contract Definition

Cool Modified Endowment Contract Definition Ideas. Mec’s are now taxed in the same. Last updated on february 16, 2022 by mark cussen in life settlements, retirement planning.

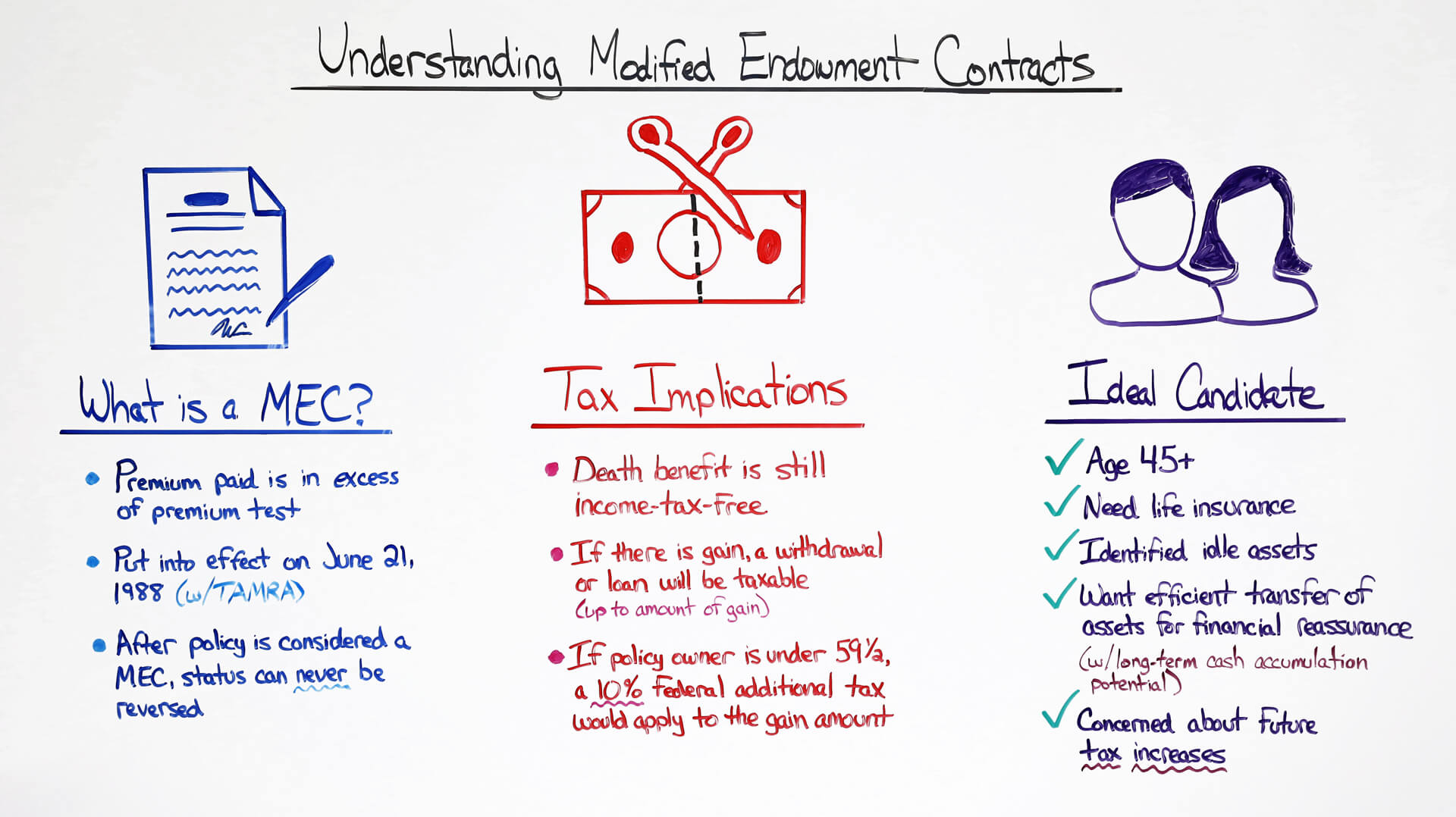

A modified endowment contract (mec) is a tax stipulation on a life insurance policy where the policy was funded with more money than federal law permits. A modified endowment contract means any contract meeting the requirements of section 7702 that was entered into on or after june 21, 1988 and fails to meet. The irs will declare a life insurance policy to be an mec if.

If The Death Benefit Under The Contract Increases By More Than $150,000 Over The Death Benefit Under The Contract In Effect On October 20, 1988, The Rules Of Section 7702A(C)(3).

A modified endowment contract (mec) is a life insurance contract that meets the requirements of code section 7702, as well as a couple of other things. The contract was created on or after june 20, 1988. The policy went in force after 6/20/1988.

A Modified Endowment Contract Is A Single Premium Life Insurance Policy That Is Taxed Differently Than Traditional Fixed Or Flexible Premium Policies.

The policy also needs to align with the statutory definition of the life insurance policy. A modified endowment contract (mec) is a tax stipulation on a life insurance policy where the policy was funded with more money than federal law permits. Management contract means the contract executed between the treasurer and a program manager.

A Modified Endowment Contract (Commonly Referred To As A Mec) Is A Tax Qualification Of A Life Insurance Policy That Has Been Funded With More Money Than.

The term modified endowment contract (mec) designates that the funding of a life insurance contract has surpassed the limits set according to federal tax law. A modified endowment contract (mec) is a designation given to cash value life insurance contracts that have exceeded legal tax limits. The irs defines a life insurance policy as a modified endowment contract if:

Procurement Contract Or “Contract” Means Any Written Agreement Of.

Last updated on february 16, 2022 by mark cussen in life settlements, retirement planning. According to us law, a modified. A modified endowment contract is taxed completely differently.

A Traditional Ira Will Tax Your Retirement Income As You Take Distributions.

A modified endowment contract means any contract meeting the requirements of section 7702 that was entered into on or after june 21, 1988 and fails to meet. As that term is defined in section 7702a of the code (or any successor or similar provision), shall identify such contract as a modified endowment. A modified endowment contract means any contract meeting the requirements of section 7702 that was entered into on or after june 21, 1988 and fails to meet.

Post a Comment for "Modified Endowment Contract Definition"