Risk Averse Definition Economics

The Best Risk Averse Definition Economics Ideas. For example, a risk averse investor may accept a low degree of risk in an investment selection, whereas risk avoidance would have the investor forgo the investment. A risk averse agent is indifferent between a gamble that offers an expected value of $15 and receiving $14 with certainty.

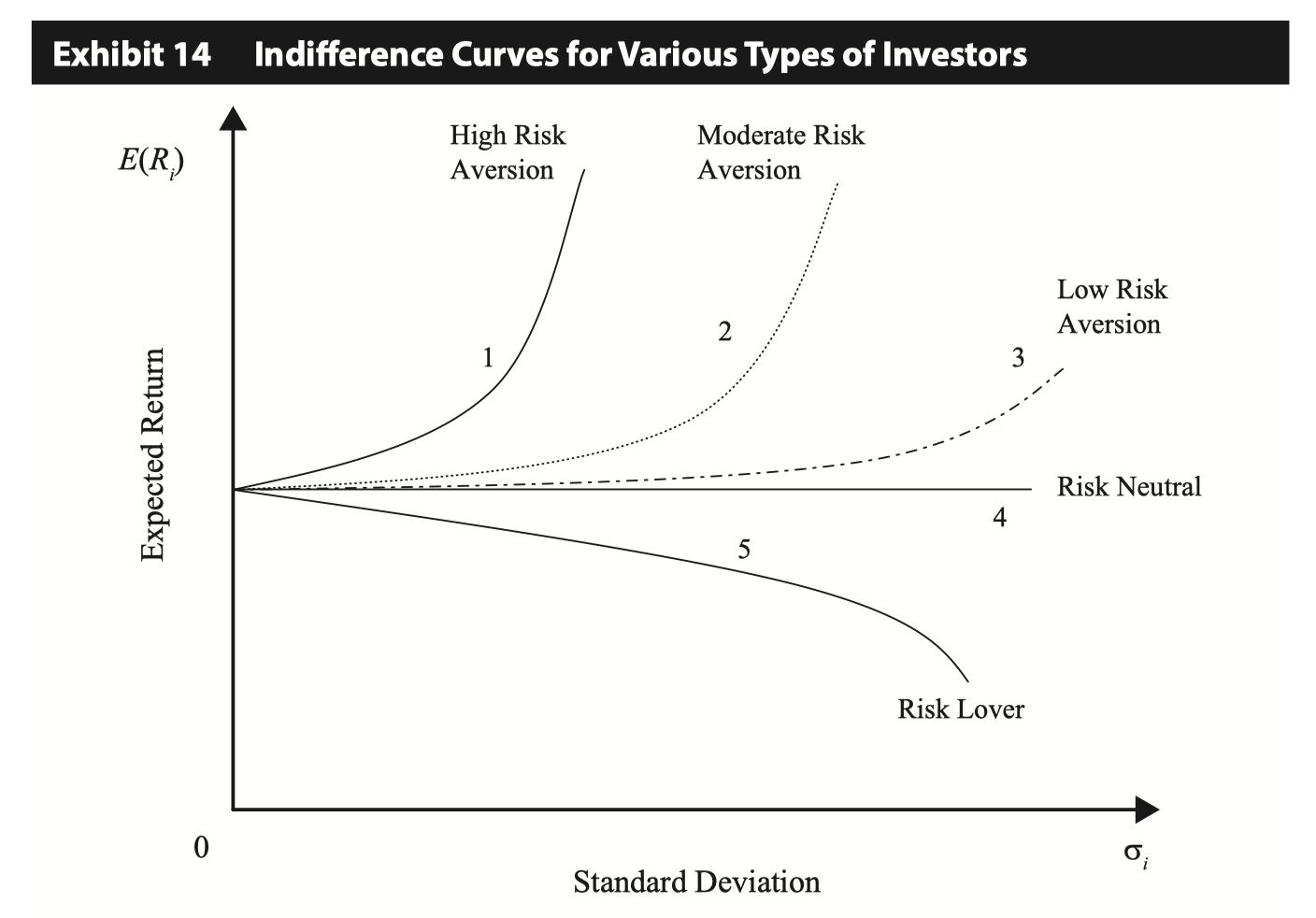

A low level or approach in the amount of risk that a negotiator is prepared to accept in a negotiation. An investor who is risk averse would consider such investments for the portfolio to maintain the risk at the lowest level possible. The subjective tendency of investors to avoid unnecessary risk.it is subjective because different investors have different definitions of unnecessary.

4 Thousands Equal To Distance Dc Is Called The Risk Premium.

For example, a risk averse investor may accept a low degree of risk in an investment selection, whereas risk avoidance would have the investor forgo the investment. Risk seekers might pursue investments such as small. Tending to avoid risks as much as possible:

Risk Aversion Is A Term Often Associated With Economics And Finance.

Measurement of risk is the measure of the volatility of an asset’s return. A low level or approach in the amount of risk that a negotiator is prepared to accept in a negotiation. It is the behavior that leads investors to take a more possessive investing approach.

Risk Aversion Is A Theory Of The Unexpected Utility Of Choice Under Uncertainty And Describes A Decrease In Preference To Increasing Risk (The Difference Between The Expected.

It describes the tendency of people to prefer low uncertainty outcomes to those with high uncertainty. The more the dispersion between. A risk averse agent is indifferent between a gamble that offers an expected value of $15 and receiving $14 with certainty.

Risk Seeking Is The Search For Greater Volatility And Uncertainty In Investments In Exchange For Anticipated Higher Returns.

An investor who is risk averse would consider such investments for the portfolio to maintain the risk at the lowest level possible. A common concept tied to risk, one which compares the risk level of an individual investment or portfolio to the overall risk level in the stock market, is the concept of beta. A risk averse investor is an investor who prefers lower returns with known risks rather than higher returns with unknown risks.

Risk Aversion (Psychology) Risk Aversion Is A Preference For A Sure Outcome Over A Gamble With Higher Or Equal Expected Value.

A negotiator who decides to accept the “sure thing” where a result is certain to be. Certain investments have proven stability and slow,. In other words, among various investments.

Post a Comment for "Risk Averse Definition Economics"